Home Improvement Loans with Bad Credit: Your Guide to Funding Upgrades

Everyone dreams of having a beautiful home. Sometimes, this means making improvements to your existing house. But what if you have bad credit? Can you still get a loan for home improvements? Yes, you can! This article will guide you through everything you need to know about home improvement loans with bad credit.

Understanding Home Improvement Loans

![]()

A home improvement loan is money borrowed to finance renovations or repairs in your home. These can include small projects like painting or large ones like adding a new room. You pay back the loan over time, usually with interest.

If you have bad credit, it might be harder to get a loan. Credit is a measure of how well you’ve handled borrowing money in the past. If you have bad credit, it means you’ve had trouble paying back loans before.

But don’t worry! There are many lenders who specialize in helping people with bad credit. They understand that everyone makes mistakes and needs a second chance.

These lenders may charge higher interest rates to offset the risk they’re taking. But if you’re diligent about making your payments on time, a home improvement loan can help improve your credit score.

Types of Home Improvement Loans

![]()

There are several types of home improvement loans. Here are some common ones:

- Personal loans: These are unsecured loans, meaning they don’t require collateral. They can be used for any purpose, including home improvements.

- Home equity loans: These are secured loans that use your home as collateral. They often have lower interest rates than personal loans.

- Government loans: Some government programs offer loans for home improvements, especially for energy-efficient upgrades.

Each type of loan has its pros and cons. It’s important to research and understand each one before making a decision.

Tips for Getting a Home Improvement Loan with Bad Credit

![]()

Even with bad credit, there are ways to increase your chances of getting a home improvement loan. Here are some tips:

- Improve your credit score: Paying bills on time, reducing debt, and checking your credit report for errors can help improve your score.

- Show steady income: Lenders want to see that you have a stable income and can afford to repay the loan.

- Consider a co-signer: If you have someone willing to co-sign the loan, it can increase your chances of approval.

Remember, it’s important to borrow only what you can afford to pay back. Over-borrowing can lead to more financial problems in the future.

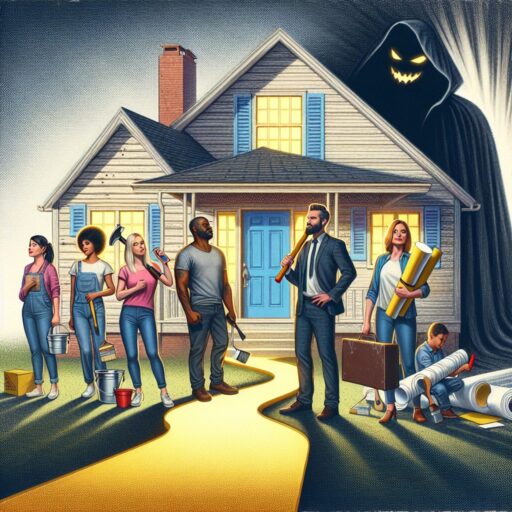

Case Study: Home Improvement Loan Success Story

![]()

Let’s look at an example of someone who successfully got a home improvement loan with bad credit.

John had a low credit score due to past financial mistakes. He wanted to renovate his kitchen but didn’t have enough savings. He decided to apply for a home improvement loan.

Despite his bad credit, John was able to secure a loan by showing steady income from his job and having his sister co-sign the loan. He also agreed to a higher interest rate.

John used the loan to remodel his kitchen. He made all his loan payments on time and even paid off the loan early. As a result, his credit score improved significantly.

Risks and Rewards of Home Improvement Loans

![]()

Like any financial decision, getting a home improvement loan has risks and rewards. It’s important to weigh these before making a decision.

The biggest risk is not being able to repay the loan. This can lead to more debt and damage to your credit score. If you use your home as collateral, you could even lose your house.

On the other hand, the rewards can be significant. A home improvement loan can help you make needed repairs or upgrades. It can also increase the value of your home. And if you make your payments on time, it can improve your credit score.

Conclusion: Home Improvement Loans With Bad Credit

![]()

Getting a home improvement loan with bad credit is possible, but it requires careful planning and consideration. By understanding the different types of loans, improving your credit score, and weighing the risks and rewards, you can make an informed decision that’s right for you.

Remember, a home improvement loan is not just about making your home look better. It’s also an opportunity to invest in your future and improve your financial health.