How to Get a Home Improvement Loan

Have you ever wanted to fix up your home? Maybe you dream of a new kitchen or a fresh coat of paint. These changes can make your house more beautiful and comfortable. But they also cost money. If you don’t have enough savings, a home improvement loan can help. This article will explain how to get a home improvement loan step by step. You’ll learn what it is, where to find it, and how to apply for it. By the end, you’ll know everything you need to start improving your home.

What Is a Home Improvement Loan?

![]()

A home improvement loan is money you borrow to fix or improve your house. You pay back this money over time with interest. Interest is extra money the lender charges for letting you borrow.

- For example, if you borrow $10,000 at 5% interest, you might pay back $10,500 over time.

- You can use the loan for many things, like fixing a roof, upgrading plumbing, or adding a new room.

There are different types of loans for home improvements:

- Personal Loans: These don’t require using your house as collateral. They are quicker but often have higher interest rates.

- Home Equity Loans: You borrow against the value of your house. These usually have lower interest rates but take longer to process.

- Government Loans: Some programs, like FHA Title I loans, help people with specific needs, like energy-efficient upgrades.

Each type has pros and cons. Choosing the right one depends on your situation.

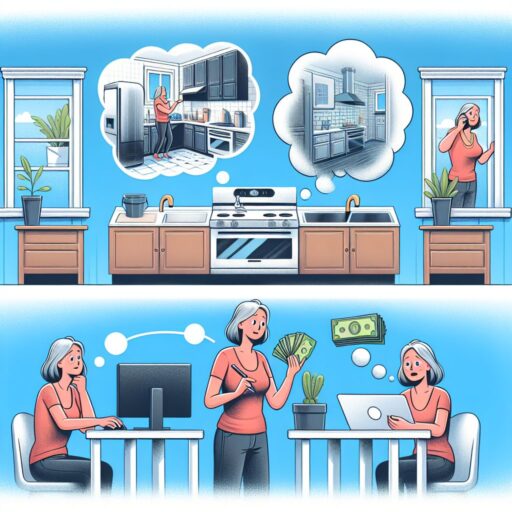

Why Do People Take Home Improvement Loans?

![]()

People take these loans for many reasons. Here are some common ones:

- Fixing something broken, like a leaking roof or old pipes.

- Making the house safer, such as installing new windows or smoke detectors.

- Adding space, like a new bedroom or bathroom.

- Improving energy efficiency with solar panels or better insulation.

For instance, Sarah wanted to replace her old carpet with hardwood floors. She didn’t have enough savings, so she got a personal loan. Now her living room looks brand new!

Statistics show that home improvement spending has been rising. According to Harvard’s Joint Center for Housing Studies, Americans spent over $400 billion on home repairs in 2022. This shows how important home improvement is for many families.

How to Decide if You Need a Loan

![]()

Before applying for a loan, think carefully. Ask yourself these questions:

- Do I really need this improvement now?

- Can I afford the monthly payments?

- Will this improvement increase my home’s value?

Let’s imagine Alex wants to add a swimming pool. He checks his budget and realizes he can’t afford the payments. Instead, he decides to wait and save money. On the other hand, Maria’s roof is leaking, and she needs to fix it before winter. She takes a home equity loan because it’s urgent.

It’s also smart to get advice from experts. Talk to contractors about costs and timelines. Speak with a financial advisor to understand how the loan will affect your finances.

Where to Find Home Improvement Loans

![]()

You can find loans in many places. Here are some options:

- Banks: Most banks offer personal and home equity loans.

- Credit Unions: These often have lower interest rates than banks.

- Online Lenders: Companies like LendingClub or SoFi provide quick online applications.

- Government Programs: Check if you qualify for special loans, like USDA or VA loans.

Each option has its benefits. For example, credit unions may be best for low-interest rates, while online lenders are faster. Compare offers from at least three lenders before deciding.

Remember to check customer reviews. A lender with good reviews is likely trustworthy. Also, avoid scams. If something sounds too good to be true, it probably is.

Steps to Apply for a Home Improvement Loan

![]()

Applying for a loan is easier if you follow these steps:

- Check Your Credit Score: Lenders look at this to decide if you’re trustworthy. A score above 700 is usually good.

- Decide How Much You Need: Get quotes from contractors to estimate costs.

- Gather Documents: You’ll need proof of income, ID, and details about your home.

- Shop Around: Compare interest rates and terms from different lenders.

- Apply: Fill out the application and submit the required documents.

- Wait for Approval: This can take a few days to a few weeks.

For example, John checked his credit score and found it was 720. He gathered his pay stubs and applied online. Within a week, his loan was approved, and he started renovating his kitchen.

Being organized makes the process smoother.

How to Manage Your Loan Payments

![]()

Once you get the loan, you must pay it back on time. Here’s how to manage it well:

- Set up automatic payments so you never miss one.

- Create a budget to track your income and expenses.

- Pay extra when possible to reduce interest costs.

- Keep an emergency fund for unexpected events.

Missing payments can hurt your credit score. For instance, if you skip three payments, your score could drop by 100 points. This makes it harder to get loans in the future.

If you’re struggling, talk to your lender. They may offer solutions like payment plans or temporary relief.

Common Mistakes to Avoid When Taking a Loan

![]()

Many people make mistakes when borrowing money. Here are some to watch out for:

- Borrowing more than you can afford.

- Not reading the fine print in the loan agreement.

- Choosing a high-interest loan without comparing options.

- Using the loan for things other than home improvements.

For example, Lisa borrowed $20,000 but only needed $15,000. She ended up paying more interest than necessary. Always borrow just what you need.

Another mistake is ignoring hidden fees. Some loans have origination fees or prepayment penalties. Ask your lender about all costs upfront.

Benefits of a Good Home Improvement Loan

![]()

A good loan can make your life better. Here’s how:

- Your home becomes more comfortable and valuable.

- Energy-efficient upgrades can save money on utility bills.

- Timely repairs prevent bigger problems later.

For instance, a report by Remodeling Magazine shows that adding a wooden deck can increase your home’s resale value by 65%. This means you get back most of what you spend.

Loans also spread out costs over time. Instead of paying $10,000 all at once, you can pay small amounts each month. This makes big projects more manageable.

Conclusion: How to Get a Home Improvement Loan

![]()

Getting a home improvement loan is a big decision. Here are the key points to remember:

- Understand what type of loan fits your needs.

- Think carefully about why you need the loan.

- Research lenders and compare their offers.

- Prepare your documents and budget before applying.

- Pay back the loan on time to avoid problems.

With careful planning, a home improvement loan can help you create the home of your dreams. Whether fixing a roof or building a new room, this guide gives you the tools to make smart choices. Start today, and soon you’ll enjoy a better, brighter home!